Navigating the complexities of 401(k) plans can be daunting, especially when it comes to ADP (Actual Deferral Percentage) and ACP (Actual Contribution Percentage) testing. These tests are crucial for ensuring your retirement plan is fair to all employees and avoids hefty IRS penalties. This guide provides a step-by-step approach to understanding and successfully navigating these tests. Failing to comply can result in significant financial repercussions, making understanding this process critical for both your company and your employees. For additional resources, check out this helpful guide.

Understanding ADP and ACP Testing: The Basics

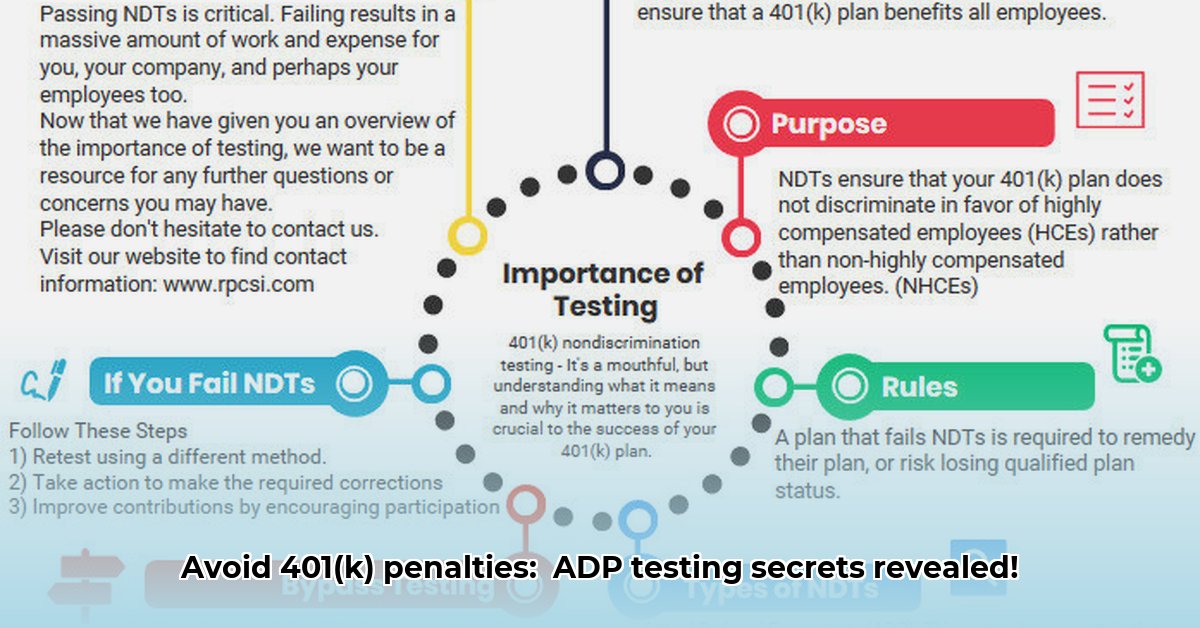

The IRS mandates annual ADP and ACP tests for all 401(k) plans. These tests compare the savings rates of highly compensated employees (HCEs) to those of non-highly compensated employees (NHCEs). The goal? To ensure fairness and prevent discrimination within the retirement plan. A failed test means your company might face substantial penalties.

Identifying Highly Compensated Employees (HCEs)

Correctly identifying HCEs is paramount. The IRS defines HCEs based on compensation and ownership within the company, often considering multiple years of salary data. This process is complex and requires careful attention to detail. Errors in HCE identification can significantly impact your test results, leading to potential non-compliance. Seeking professional guidance is often recommended given the intricacy of the IRS regulations.

How ADP and ACP Testing Works

ADP testing compares the percentage of salary contributed to 401(k) plans by HCEs and NHCEs. ACP testing performs a similar comparison but considers total contributions, including employer matching. The IRS uses specific formulas to determine if there is a significant disparity between the groups. A substantial difference can lead to a failed test. While manual calculations are possible, using specialized software significantly reduces errors and simplifies the process.

Choosing Your Testing Timeframe: Current Year vs. Prior Year

A strategic decision must be made regarding the timeframe for testing: the current year or the prior year. Current year testing offers the most up-to-date information, but it may not accurately reflect future contributions. Prior-year testing provides a more stable data set but may not reflect current contribution patterns. The choice depends on the risk tolerance and the stability of employee contributions.

Fixing a Failed Test

Failing an ADP test doesn't necessarily mean financial ruin, but it necessitates immediate corrective action. Ignoring a failed test can result in penalties, so swift action is crucial. The IRS offers correction methods through the Employee Plans Compliance Resolution System (EPCRS) 1, but these methods have deadlines and potential consequences for your plan's structure.

Common Mistakes to Avoid

Several common errors can lead to non-compliance. These include inaccurate data entry, incorrect classification of employees (HCEs vs. NHCEs), and poor record-keeping. A proactive approach, meticulous attention to detail, and professional assistance when needed are crucial for avoiding these pitfalls. Are you confident in your ability to navigate these complexities independently, or would professional help provide valuable peace of mind?

Technology and Expertise: Leveraging Your Resources

ADP testing is complex. Specialized software can automate many aspects, reducing the risk of manual errors. However, engaging qualified retirement plan professionals is crucial, especially for complex situations or critical decisions. The cost of professional advice is often significantly lower than the cost of facing IRS penalties. Do you prioritize proactive cost-effective measures or risk potential financial consequences?

Long-Term Compliance: An Ongoing Process

ADP testing isn't a one-time event; it's an ongoing commitment. Regular review of your plan’s structure, employee contributions, and HCE classifications is essential. Keeping abreast of changes in IRS regulations ensures consistent compliance and minimizes risk. Is your current process adequate for maintaining continuous compliance, or could improvements provide additional protection?

Your Action Plan for Compliance: A Step-by-Step Guide

Following these steps helps maintain 401(k) plan compliance:

- Gather Accurate Data: Meticulously collect and verify employee compensation and contribution information.

- Classify Employees Correctly: Precisely classify employees as HCEs or NHCEs according to IRS guidelines.

- Test Regularly: Conduct annual ADP and ACP testing, ensuring timely compliance.

- Monitor Proactively: Regularly review your data to identify potential issues early.

- Seek Expert Advice: Consult qualified professionals when needed to navigate complex situations or ensure the accuracy of your analysis.

Proactive planning and meticulous execution are critical for ensuring compliance and protecting your company and employees. Professional help can provide invaluable support, mitigating risks and saving both time and money.